The current geo-political developments show that energy supply and also supply chains for key components needed for the energy transition are fragile. Obviously, green hydrogen can play a crucial role as it will allow for more domestic generation in comparison to natural gas and a diversification of supply relationships. Sometimes overseen but no less important is that green hydrogen is also an answer to foreseeable dependencies that could slow down the energy transition – such as on lithium.

FROM CHAMPAGNE TO MINERAL WATER

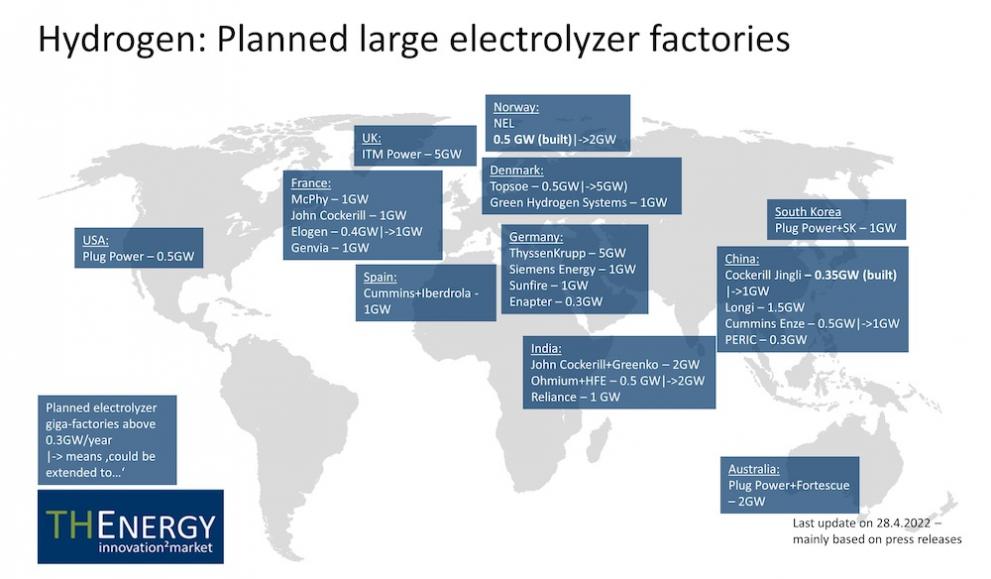

At the moment, green hydrogen might still be the champagne of the energy transition, but current developments give hope that this will change soon. In Europe, the Norwegian manufacturer Nel has recently opened the first fully automated alkaline electrolyser factory with a capacity of 500 MW/year and claims to be on track for bringing down the costs of green hydrogen to 1.5 USD/kg by 2025. This would make it competitive to grey hydrogen produced by steam reforming of natural gas.

The competition never sleeps: Siemens Energy has announced plans to inaugurate a gigawatt PEM electrolyser factory in Berlin next year. And these are just some examples of companies that decided to throw down the gauntlet in the competition to build the biggest electrolyser factory. Other giga-scale electrolyser factories have also been announced by Cummins, ThyssenKrupp, Fortescue Future Industries, McPhy, ITM Power, Plug Power, Ohmium, Sunfire and John Cockerill. In hydrogen, size matters which translates into substantial cost advantages and goes hand in hand with additional savings from falling prices of solar and wind energy.

THE COLOUR OF HYDROGEN WILL BE GREEN

In light of the falling costs of green hydrogen it is obvious that there is no need for intermediate solutions to bridge the time until green hydrogen is fully competitive. Advocates of blue hydrogen (an immature process based on natural gas in which the CO2 is captured and stored) ignore the dynamics in cost-degradation of green hydrogen - a mistake that many analysts also have made regarding solar and wind power.

While no one should hold back private companies that decide to take the route towards blue hydrogen, government incentives and subsidies are however only expedient if used for accelerating green hydrogen. There are no direct spill-over effects between blue and green hydrogen which means that each euro invested in blue is lost for bringing down the costs of green hydrogen.

EVALUATING THE ENERGY TRANSITION FROM THE END

Many environmentalists are sceptical towards green hydrogen because of a low round trip efficiency of less than 50% for storage applications while batteries are in the range of up to 97%. Due to the falling prices of renewables and electrolysers the efficiency alone is not really of primary importance. It actually reveals a general lack of renewables that exists anyhow and that will be even bigger if we are heading towards a hydrogen economy.

As the price for green hydrogen continuous to fall more and more applications will break even. Some analysts propose a hydrogen ladder for prioritising applications that should shift towards green hydrogen. Taking into account that it takes time to develop new applications it is questionable if it makes sense to development these applications one after the other.

We must think through the energy transition from the end considering all dynamics regarding prices and availability of resources. If hydrogen is needed to decarbonise a certain application, it is crucial to start the development now in order to ensure that these hydrogen-based applications are mature when we need them.

Sometimes the one-dimensional view on costs also ignores that hydrogen has some advantages for the user. For instance, vehicles that are highly utilised will struggle to with long charging times: not only in the transport segment but also for passenger cars.

AFTER HAVING PUT ALL CARDS ON RUSSIAN GAS WE SHOULD NOT TO PUT ALL CARDS ON BATTERIES NOW

The current crisis shows us how fragile supply chains are. This is valid for natural gas itself but also for key components that are needed for making the energy transition a success. There is a certain risk that we repeat the mistake that we have done with Russian gas. The energy transition is a huge undertaking. Due to the intermittencies of solar and wind energy storage will play a key role.

Electrification will require huge amounts of scarce resources that are not locally available in many industrial countries – such as lithium. This will create new dependencies. Mastering these tremendous challenges will also be about diversification – and playing the hydrogen card.

Recommended links:

- Global Hydrogen Review, IEA (2021) https://www.iea.org/reports/global-hydrogen-review-2021

- Geopolitics of the Energy Transformation: The Hydrogen Factor, IRENA (2021) https://www.irena.org/publications/2022/Jan/Geopolitics-of-the-Energy-Transformation-Hydrogen

- Hydrogen News https://www.linkedin.com/groups/8847204/ (world’s biggest hydrogen community – information about latest developments and projects)

About the author:

Dr Thomas Hillig is managing director of THEnergy, a boutique consultancy specialised in innovations for the energy sector. The consulting focus is mainly on microgrids, energy storage, hydrogen and decarbonisation for commercial and industrial clients.

Disclaimer: This article is a contribution from a partner. All rights reserved.

Neither the European Commission nor any person acting on behalf of the Commission is responsible for the use that might be made of the information in the article. The opinions expressed are those of the author(s) only and should not be considered as representative of the European Commission’s official position.

Related articles:

➔ Convergence of geopolitical, energy and climate crisis urges us to act and co-operate

➔ If we really want to put energy efficiency first, here's how

➔ Five steps to organising a successful sustainable energy day

Details

- Publication date

- 3 May 2022

- Author

- Thomas Hillig